some Q1 thoughts... and what to expect from the rest of 2023

Report by: Ben Jones Published: 5th April 2023

Key points:

- SVB’s collapse is showing the strain that higher rates is placing on the financial system

- We believe we’re at peak rates and further tightening from here would be a policy mistake

- We expect a recession later this year or next year, with disinflation continuing through 2023 and the unemployment rate rising

- A recession will force the Fed to be more accommodative with monetary policy which will boost gold and treasuries. We expect equities to be choppy as earnings suffer through recession but accommodative monetary policy buoys the market

As we’ve approached peak rates, Q1 has been dominated by huge shifts in pricing the Fed’s approach to monetary policy. The Fed misjudged reviewing 50bp hikes just 2 days before Silicon Valley Bank’s (SVB) collapse which contributed to wild swings across the bond market not seen since 1987. Treasuries, equities and gold were all driven higher as investors price in rate cuts for 2023 and grow concerned over counterparty risk in the banking system.

So what happened in Q1? Stronger than expected labour market data in February caused a sell-off across the markets as investors re-priced rates higher, but that all reversed the day that Silicon Valley Bank (SVB) collapsed. Just two days before the collapse, Jerome Powell told the markets that the Fed might be prepared to hike the Fed funds rate by 50bps in March, from 4.75% to 5.25%. This was a mistake from the Fed who have been too complacent about the lag between policy tightening and the impact on the real economy. Never in history has the US economy avoided recession once CPI has exceeded 5%, yet the Fed brushes history aside and continues to talk up the probability of a soft landing. The soft landing view looks increasingly implausible.

SVB’s collapse marked the largest bank collapse since 2008. The reason for the collapse was poor management from SVB who placed focus on growing their deposit base as fast as possible. They invested the deposits in Treasuries in 2021 and watched the value of these treasuries lose around 20% as rates rose significantly through 2022. Interest rate hedges had been removed leaving SVB exposed to the losses that were significant enough to wipe out their equity. SVB tried to cover the losses through a legal accounting loop-hole that allows them to value the treasuries at par on the books, rather than mark them to market. However, once the market realised the extent of the true losses, depositors panicked and withdrew all deposits. The ensuing bank run killed SVB.

Treasury Secretary Yellen and the FDIC tried to calm the markets by announcing that all SVB depositors would be made whole. However, they refused to confirm that all deposits above $250k across all banks would remain safe, and that they would only act to prevent systemic risk. In other words, they would only guarantee deposits at ‘too big to fail’ banks. This leaves small banks at significant risk of losing deposits to the large banks. In the last week, small banks have suffered the largest weekly outflows of deposits in history. The panic also forced Credit Suisse (CS) underwater and regulators forced a rescue deal between UBS and CS. While I think it is likely that a number of small banks fail in the wake of SVB, I do not see a replica of the financial crisis of 2008. SVB’s mismanagement was unique to them and CS have been in a financial hospice for quite some time.

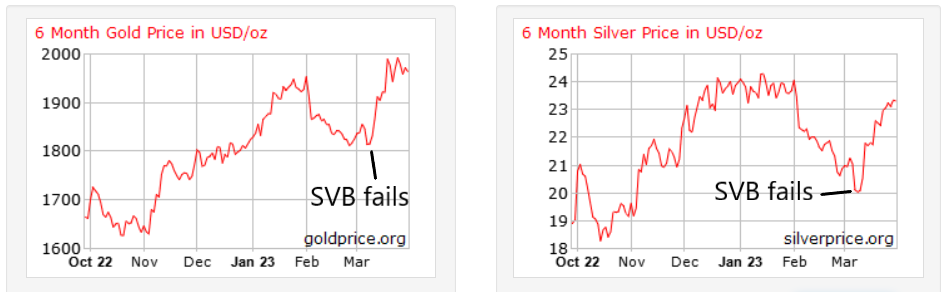

In response to the SVB collapse, the 2 year yield which had just topped 5%, dropped to 3.90% in 3 days and now sits at 4.10% as I type. The 10 year yield dropped from 4.0% to 3.40% as the 2y10y spread rose from -107bps (the most extreme level since 1981) to around -50bps. The market moved from pricing hikes this year to now pricing 2-3 cuts. This, of course, is great for gold which responded by rallying from $1800/oz to $2000/oz and rests around its highest ever monthly close. Silver rallied from $20/oz to $24/oz although it still trails gold relative to their long-term historic ratio. The gold-silver ratio (GSR) is 83 currently versus its long-term average of around 60.

You can see the impact of the SVB failure on gold and silver in the charts below.

Source: goldprice.org

The chart below shows the December 2023 Fed Funds future (FFZ3). This shows what the markets are pricing the Fed Funds rate to be by December 2023. The implied rate is 100 minus price. We can see that at the beginning of Feb, the price was around 95.50 implying a Fed Funds rate of 4.50% (100-95.50). Strong labour market data and hawkish Fed speeches throughout Feb pushed the market to re-price FFZ3 to 94.50, implying a 5.50% FF rate. That would mean two additional hikes from present levels. You can see the moment SVB fails and the market immediately moved from 2 further hikes this year to 4 cuts, now settling at 2-3 cuts.

Chart of December 2023 Fed Funds Futures (FFZ3)

Source: marketwatch.com

What does this mean for the rest of the year? Never in history has the US avoided recession once CPI has exceeded 5% and we expect this time to be no different. Historically, monetary policy has always acted with a lag although this lag can vary from 12 to over 24 months. The first large rate hikes began in March 2021 so we are moving to the period where we expect to see policy tightening impacting the economy. We have seen or expect to see this in the following ways:

- SVB collapse and banking turmoil.

- Disinflation (inflation has been falling from peak 9.1% in June 2022 to 6.0% in the latest reading of Feb 2023)

- Labour market weakening (we haven’t seen this yet but expect the unemployment rate to rise later this year).

- Negative GDP growth (not yet seen although growth forecasts are being revised down and we expect to see them turn negative later in 2023 or early 2024).

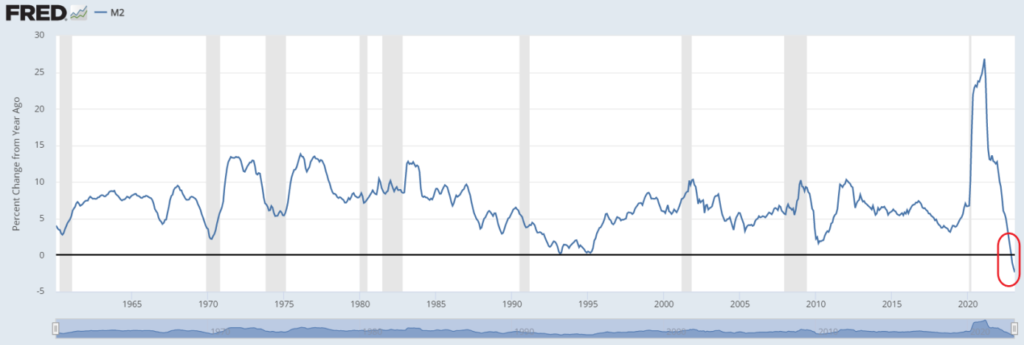

If we are correct, this will force the Fed to be more accommodative with monetary policy. Money supply growth turned negative YoY for the first time since the Great Depression and has been a reason for gold’s struggle through 2022. A shrinking money supply is an incredibly powerful disinflationary tool which will quickly act to create a recession. I am not aware of any circumstances where a recession has been avoided during periods of negative YoY money supply. Once recession hits, the Fed will be forced to resume growth in the money supply which will push gold higher.

The chart below shows the first instance of declining YoY money supply since available data but the last negative print was the Great Depression.

M2 YoY goes negative for the first time since the great depression

Source: FRED

Given our expected combination of recession and monetary easing, we would expect:

- Mixed results for equities as recession hurts earnings but accommodative monetary policy supports the market

- Gold to rally on accommodative monetary policy

- Treasuries to rally on accommodative monetary policy