unemployment is coming, look busy job market strength won't last

Report by: Ben Jones Published: 5th August 2022

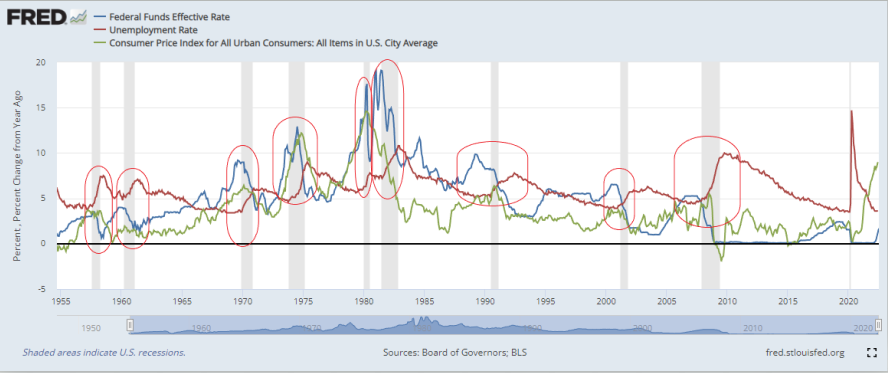

- Unemployment follows peak Fed Funds rate with a lag

- Typically unemployment barely begins to rise until a hiking cycle nears its peak, leading to a misconception of a strong labour market

- The S&P 500 tends to bottom somewhere between peak rates and peak unemployment

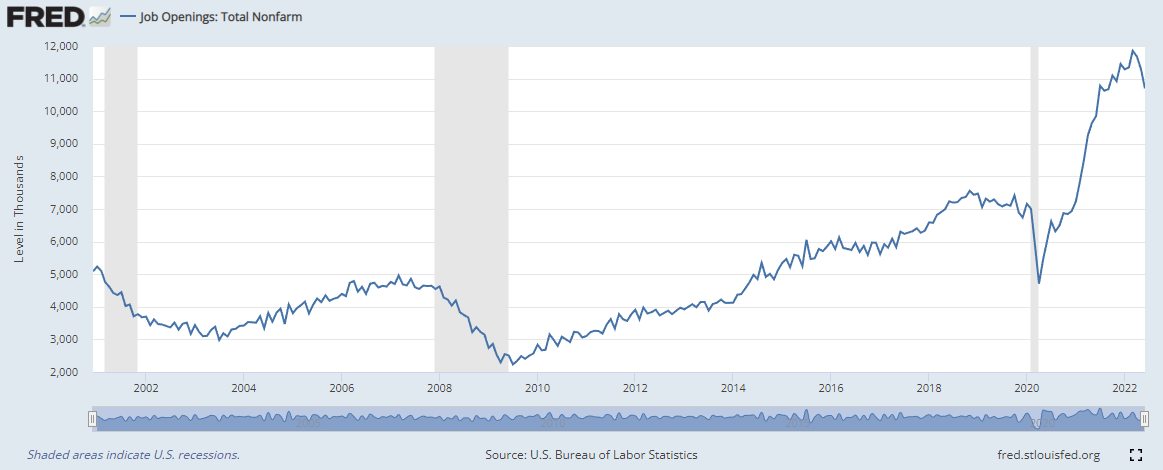

Job Openings

Source: FRED

The latest job openings print for June this year showed the third biggest monthly decline on record (the top 2 being the onset of Covid in 2020).

Source: FRED

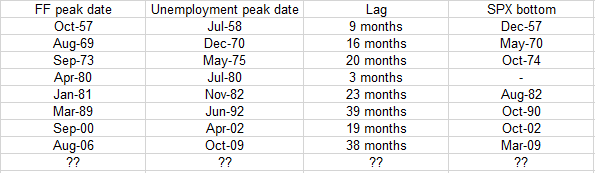

Below is a table with the lag between FF peaks and unemployment peaks

Source: FRED & Ben Jones Investments

The inflationary periods from 1969 through to 1982 show 16-23 months lag between FF peaking and unemployment peaking to be around standard. This at least gives us an indication of how long we can expect a weak economic environment to persist. In each of the 1970, 1974 and 1980 recessions, unemployment didn’t begin to pick-up until 2 years after the Fed started raising rates. Admittedly, the increase in the FF rate this time around has been far more aggressive and unemployment may come sooner, but it wouldn’t be surprising if the weak jobs data didn’t surface until 2023. Much may be made of ‘stronger than anticipated’ non-farms payrolls over the next 2-3 months, but it would be naive to think that a strong jobs report in August in any way suggests a robust labour market through the next 2 years.

The Fed are telling markets that they’re prepared to maintain high rates for as long as it takes to bring inflation down, but I’m not convinced they’re prepared for the popular and political backlash that will come from both high inflation and a high unemployment rate. It was the popular discontent of high unemployment that forced Fed Chair Arthur Burns to back down from tightening policy in 1975 and allowed stagflation to continue. The US also suffers from high levels of public debt that make Volcker’s high real rates for longer policy less tenable today (see my piece Managing Inflation for more on this).

I looked at the S&P 500 to see where it bottoms through these cycles. The S&P 500 tends to find a bottom somewhere between FF peaking and unemployment peaking. Whilst there are many other factors in determining the path of the S&P (not least their valuations), this alone would suggest we’ve not yet seen a bottom and it’s better to wait until we’ve seen cuts from the Fed.

We’re also seeing statements large companies looking to cut jobs or slow hiring:

- Amazon cut 100,000 jobs

- Apple, Alphabet and Meta all to slow hiring

- Robinhood cut 23% of jobs

- Tesla on a hiring freeze and considering cutting 10% of workforce

- Shopify cuts 10% of workforce

- Netflix has laid of 300 workers

- Ford plans to layoff 8000 employees

- JPM cuts 1000 jobs

While anecdotal, it’s worth keeping an eye on the hiring plans of large corporations.